Investing for

the Long Term

Our business by numbers

Established in 1986, we have been investing for over three decades.

Our holdings are diverse and global.

Our investment portfolio is valued at more than $35 billion and spans a range of sectors.

Founded by Len Blavatnik

Our company was founded in 1986 by businessman and philanthropist Len Blavatnik. His ability to spot opportunities and invest against the grain has led us to generate consistent returns across an expanding portfolio for more than three decades.

Learn More About Len Blavatnik“He clearly wants to make sure that there is a legacy of philanthropy that he can leave, as well as a legacy of business. He wants to do things that will have enduring impact.”

Nitin Nohria, Former Dean of Harvard Business School, in the Financial Times

Our holdings are diverse and underpinned by a set of common principles.

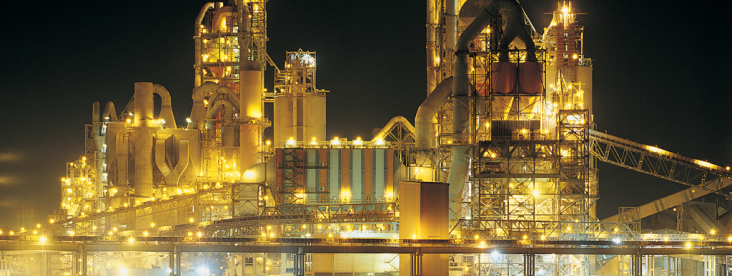

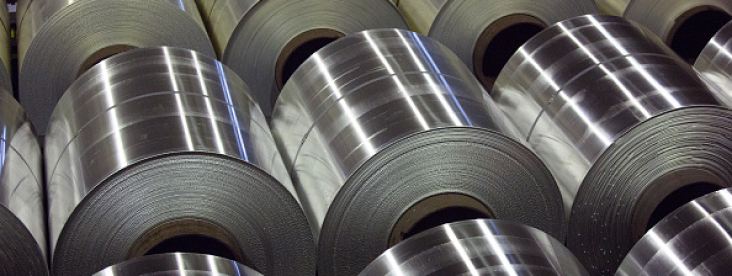

A Diverse Portfolio

Our broad footprint across sectors and geographies gives us the ability to be opportunistic in the face of economic disruption.

Leading Investors

Our investment leads are experts in their fields, with deep networks and decades of experience. They are empowered to act quickly and be ambitious when they identify an asset with long-term growth potential.

A Long-Term Approach

We are not dependent on external capital and therefore can make long-term investments on businesses that need time and support to reach their potential.